SCENARIO 10: Catch-up Payments

In this scenario your borrower missed some payments and is now catching up.

If payments have been missed and correctly accrued, then the catch-up payment should reduce the amount accrued or clear it completely.

Click on the Record Payments worksheet.

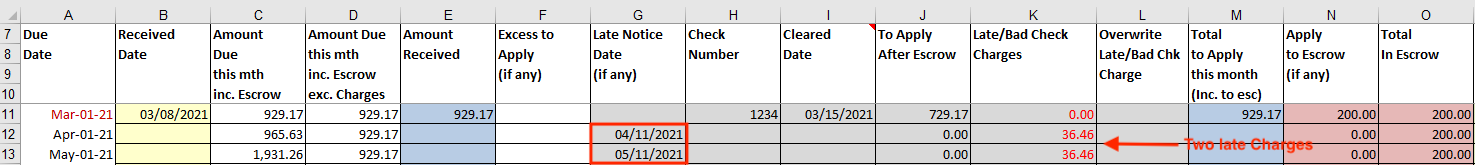

In our example below, the borrower has made their first payment for March 1 2021, but has failed to pay April or May 2021. In June 2021 they are catching up their payment.

Firstly, we have entered the correct payment received on time for March 1 2021. We then entered the payments for April and May 2021 by entering a date in Column G to accrue the payment. That's it, nothing else is required to accrue a payment apart from a date in Column G.

You will see that two Late Charges have been triggered, as the date entered in Column G is after the Days Before Late, which in our example is 10 days.

Before trying to catch-up a payment, learn how to enter no payments received correctly. It is very important that this is done correctly so that your missed payments are accrued.

How much does the borrower owe?

If you look at the payment for April 1 2021, you'll see that in column C the amount owed is the normal payment of $929.17 plus the $36.46 Late Charge. The total is therefore shown as $965.63.

The May 1 2021 payment has also been accrued with a Late Charge, which means that a second charge has been accrued. The total shown in Column C for the May 1 2021 payment is $1,931.26.

That is now showing that both the April and May 1 2021 payments are owing at $929.17 each plus 2x Late Charges of $36.46.

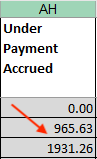

If you scroll across to Column AH, you will see the Under Payment Accrued for the two missing months.

How to enter a Catch-up payment

In our example, we are assuming that we have talked to our borrower who is aware that they have missed 2x payments and owe 2x Late Charges. They have advised us they are sending their June 1 2021 payment for 3x payments including the current month AND they are including extra for the Late Charge.

All you have to do now is enter the June 1 2021 payment correctly and apply it to catch-up all the missed payments.

We are assuming that we received the June 1 2021 payment on time and will not enter it.

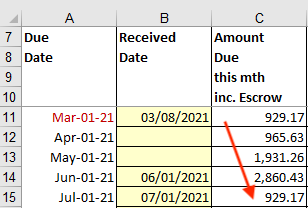

To do so, firstly enter a date in Column B. In our example, we have entered 6/1/21.

As soon as you enter a date in Column B, you will see the Amount Due shown in Column C. The amount shown is $2,860.43. That is 3x payments including the one for June 1 2021 and 2x Late Charges for the missed months.

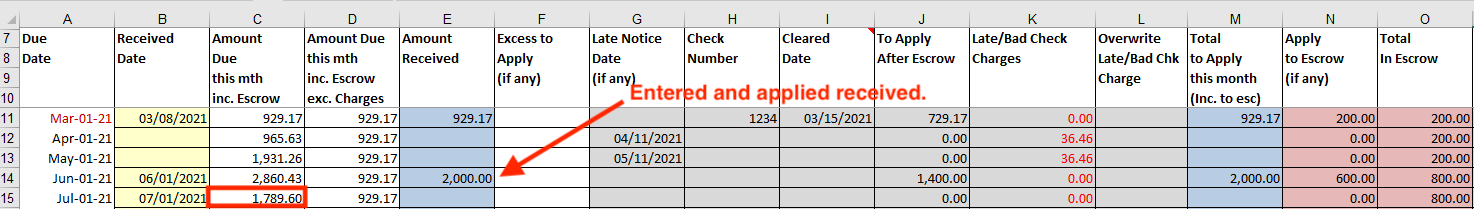

In our example, the borrower actually sent a check for $2,860.43, so we are going to enter that in Column E. After you have entered the payment, apply it by entering the same amount again in Column M.

You will Notice that not only has the payment been caught-up, but also the Escrow which you can see in Column N.

What about Next Month?

Next month, all you have to do is enter your normal payment as usual, assuming you receive it.

In our example, we have entered 7/1/21 which has immediately triggered the Amount Due in Column C for July 1 2021 which you can see is now $929.17.

What if not all of the payment was received for June 1 2021?

If you didn't actually receive the entire catch-up payment, all you'd need to do is enter what you did receive.

In our example, instead of entering $2,860.43 for June 1 2021, we have only received $2,000.00, so that's what we've applied.

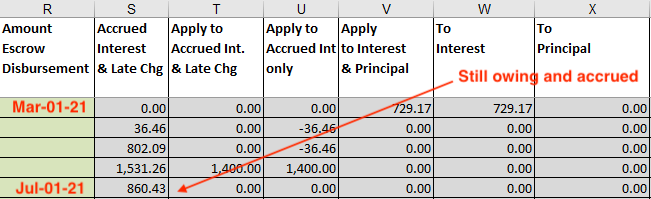

By entering the payment like this, you'll see that for July 1 2021, the amount due in Column B is now $1,789.60 and not $929.17, because the June 1 2021 payment was $860.43 less than it should have been.

What if not all of the payment was received for June 1 2021?

For this last example, where the catch-up payment was insufficient to clear all fo the accrued interest and charges, scroll across to Column S and you'll see the Accrued Interest and late Charge owing.

You can also scroll further to Column AH which will show you the Under Payment Accrued.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.