Daily Late Charges

Lender Spreadsheet provides the functionality that you can have a Daily Late charge that accrues every day a payment is late based on a $ amount, as opposed to a Single Late Charge payment based on a % of the monthly Payment Amount.

For example:

You could charge a $1 fee per day for any late payments or whatever your agreed legal amount is.

if your grace period is 10 days and you received your payment on the 12th of the month, there would be a late fee of 2x your daily fee for being 2 days late.

Setup the Daily Late Charge

Click on the Setup worksheet.

If you want to use a daily rate, clear the 5.00% in cell B48 and instead insert a number into cell D48. You will receive a warning if you haven't cleared cell B48 first as you CANNOT have both a % charge and a daily charge.

What the Daily Late Charge Looks Like

Click on the Record Payments worksheet.

A Daily Late Charge is shown in the same place as a % Late Charge in Column K.

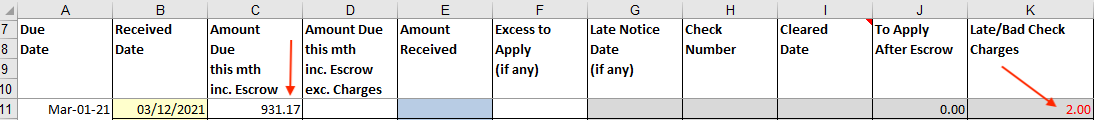

In our example below the payment is going to be 2 days late as the Grace Period is 10 days.

Enter 3/12/2021 in Column B.

You will immediately see that that in Column C the Amount Due this month is shown as $931.17.

The amount due should be $929.17 including $200.00 escrow.

Now if you look across to Column K you will see that the Late Charge is shown as 2.00. This is because you set your Daily Late Charge as $1.00 per day and the payment is 2 days late.

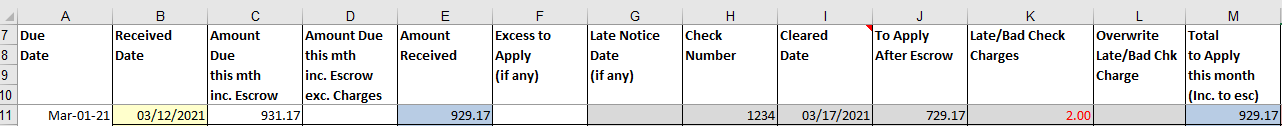

Now enter the Amount Received in Column E and the Amount to Apply in Column L.

Enter $929.17 in both as this is the normal payment and the borrower has NOT INCLUDED THE LATE CHARGE.

We have also added in the Check Number in Column H and the Cleared Date in Column I for clarity (both are optional).

The $2.00 Late Charge has been accrued as it was not paid by the borrower in this example.

No Payment Received After Grace Period

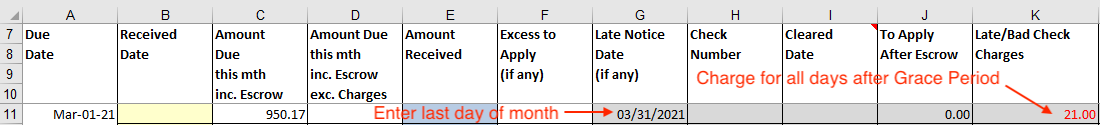

In our next example, we have received NO PAYMENT at all for the month of March 2021.

Because we have received NO PAYMENT we need to Accrue the month.

To Accrue the Payment, enter a date in Column G.

Enter 3/31/2021in Column G.

In our example because this is a Daily Late Charge and we received no payment, enter the last day of March 2021 and the Daily Late Charge will be triggered to accrue ALL DAYS AFTER the Grace Period.

What does the Next Month Look Like?

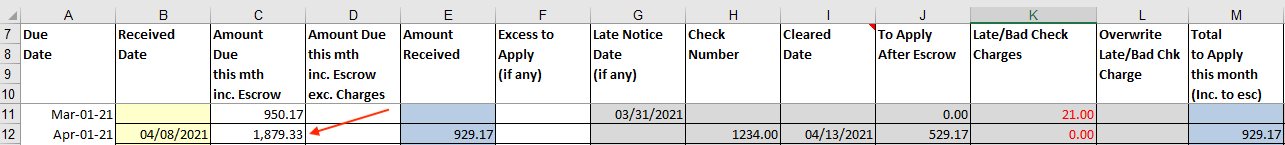

After receiving NO PAYMENT in March 2021 the normal payment was received on time for April 2021.

We have entered the April 2021 payment as normal.

As you can see, the March 2021 payment has the Late Charge, but the April one does not as that March Late Charge is for March and does not continue into April. However, because it was not received, it is accrued.

For April 2021, the amount shown as owing in Column C is $1,879.33, as it includes the $950.17 that was owed for March (including Late Charge) that was not received AND what is now owed for April 2021.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.