Closing Disclosure

Quick Links

Background to the Closing Disclosure

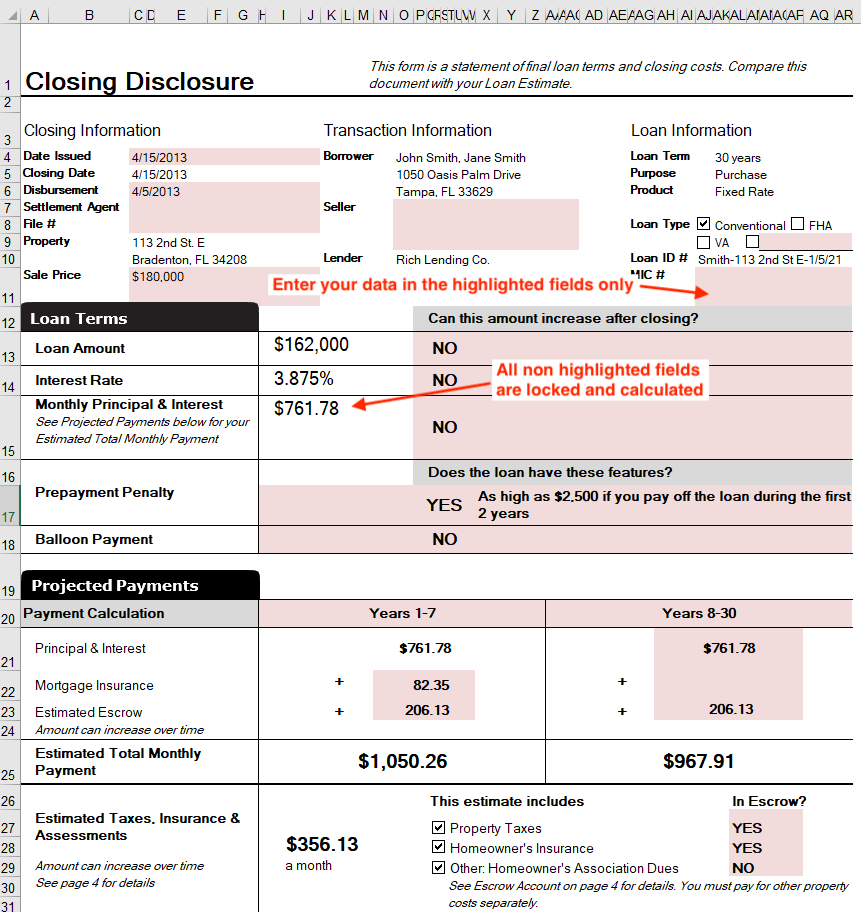

The Closing Disclosure is designed to inform a borrower of the final details about their mortgage loan and is the final version of the Loan Estimate.

The Closing Disclosure is a 5 page form that a borrower must receive at least three business days before closing a mortgage loan, that includes the loan terms, projected monthly payments, fees and other costs (closing costs).

Learn more about the Closing Disclosure:

To make sure you use the correct form, check the Consumer Financial Protection Bureau website for blank forms, samples and further help, as well as learning more about the Closing Disclosure.

- What is a Closing Disclosure at the Consumer Finance Protection Bureau (cfpb)

- Closing Disclosure forms and samples at the Consumer Finance Protection Bureau (cfpb)

- Closing Disclosure Explainer at the Consumer Finance Protection Bureau (cfpb)

Below are some forms from the Consumer Finance Protection Bureau (cfpb). These were the latest forms at the time of publishing and have not been updated for several years, but please check the cfpb website in case there are new versions.

What Closing Disclosure do we provide?

Lender Spreadsheet provides an editable sample Closing Disclosure form.

This form is purely for information only and is for a Fixed Rate loan.

Create Closing Disclosure

Firstly, make sure you have entered all the setup information for your loan correctly, as some fields on the Closing Disclosure form are automatically calculated for you.

Click on the Closing Disclosure worksheet.

Enter your data in the highlighted fields only. All other fields are locked and automatically calculated.

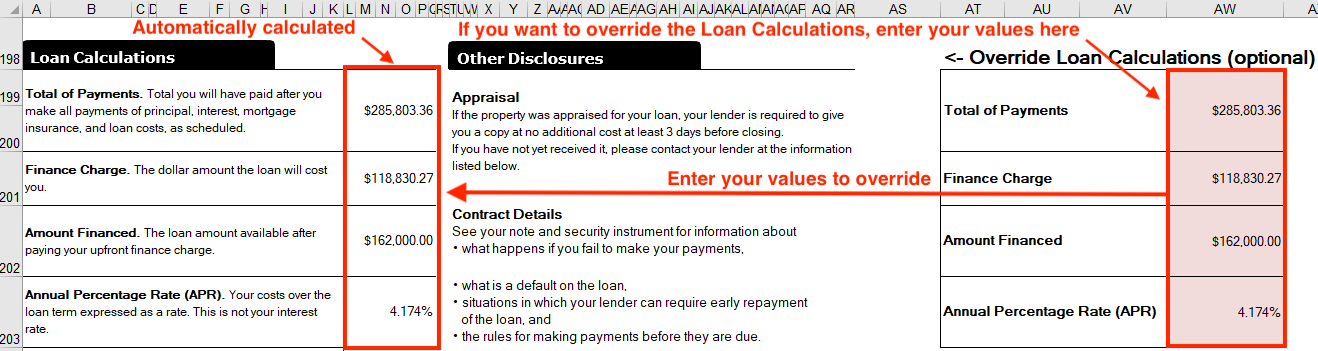

Loan Calculations

There are fields on Page 5 that are automatically calculated, but we allow you to override these calculations if you choose.

To assist you, below are links to further information on what these fields are and what they include:

What is the Total of Payments?

Learn about the Total of Payments and what it means.

What is the Finance Charge?

Learn about the Finance Charge and what is included.

What is the Amount Financed?

Learn about the Amount Financed and what it means.

What is the Annual Percentage Rate (APR)?

Learn about what's included in the APR and what it means.

Our form also allows you to adjust the amount of mortgage insurance that will be included in the loan. This will be added to the Total of Payments under Loan Calculations.

Remove the Pink Color BEFORE Printing

The pink highlighted cells are designed to make it easy for you to enter your data and identify which cells are unlocked. However, for printing this is not ideal as the pink collar will be printed too.

Remove the highlight color from unlocked cells

It is easy to remove the pink highlight from editable cells. Learn how to remove the highlight color.

Print your Loan Estimate

It is easy to print your Loan Estimate or save it as a pdf file. Learn more about printing and saving to pdf.

Add an Electronic Signature

If you intend to save your form as a pdf and email it to your borrower, you can add an image of your signature, so that you do not need to print the form to paper first, sign it and then scan it to pdf. Learn how to add an image of your signature to your form.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries.

Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.