SCENARIO 8: NO Payment received

This scenario is when you receive NO payment at all for the month it is due.

If you have received NO payment, you can instruct Lender Spreadsheet Pro to automatically accrue the payment. The choice you have to make is if you wish to automatically accrue a Late Charge or not.

As long as you follow the instructions below, your outstanding interest and any fees will not be forgotten.

Before looking at the Late Charge, we need to tell Lender Spreadsheet Pro that NO payment was received.

Click on the Record Payments worksheet.

You only enter a date in Column G to accrue a missed payment.

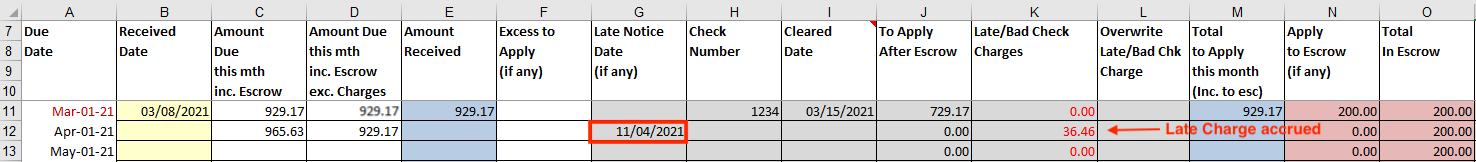

In our example, the payment due for April 1 2021 has not been made.

Because no payment has been made you DO NOT enter a date in Column B or a Zero amount in Column E as this is NOT necessary.

All you have to do is enter a date in Column G and the payment will be accrued.

In our example below, the date 4/11/2021 has been entered in Column G.

You do not need to enter anything else, just a date.

The Date is important

The date you enter in Column G is very important.

The reason is that if you enter a date that is BEFORE your Days Before Late period ends, NO Late Charge will be triggered. But, if you enter a date AFTER the Days Before Late ends, a Late Charge will be automatically applied and accrued.

In our example, we have setup our loan that a payment is late after 10 days. If we entered a date of 4/10/2021 or less, NO Late Charge would be triggered.

Because we have received NO Payment, we do want a Late Charge, so we have entered a date that is AFTER the Days Before Late period ends. In fact, any date from 4/11/2021 to the end of that month will trigger a Late Charge.

Our User Guide contains detailed information on the different types of Late Charges and how they are applied.

Learn more about Late Charges.

What happens next month?

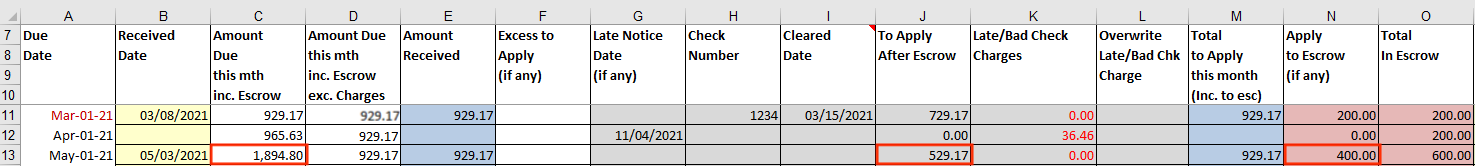

After NO payment was received in April 2021, the normal payment was received in May 2021.

In our example, we have entered a normal payment for May 2021 and entered a date of 5/3/2021 and applied the payment as normal.

In our example, when the Date of 5/3/2021 is entered into Column B, the amount due is shown as $1,894.80.

The breakdown of this amount is as follows:

1. Payment due from April 1 2021: $929.17

2. Late Charge due from April 1 2021 payment: $36.46

Total: $965.63

Plus, the payment that is due for May 1 2021 which is $929.17.

Total: $1,894.80

How is this payment applied?

Look across to Column J and it shows that the Amount to Apply is only $529.17 out of the $929.17 that was actually paid for the May 1 2021 payment.

The reason for this is that NO escrow was paid in April 2021 as there was no payment. The amount expected for April 1 2021 was $200.00. When the May 1 2021 payment is entered, the escrow is automatically taken off the payment for the previous month, plus the escrow which is due for the current month.

In Column N you will see that $400.00 has been applied to Escrow to catch-up from April's payment.

What about the Late Charge

As the Late Charge was NOT paid in the May 1 2021 payment, it has been accrued as owing.

If the borrower had increased their payment by the amount of the Late Charge, then it would have been paid and no longer outstanding.

If the borrower never pays the Late Charge, then it will always be accrued and not forgotten about and would be included in any future payoff.

Learn how to enter a payment including the Late Charge.

If your missing payment is due to a Bad Check, follow the next example for Scenario 9 by clicking on the button below.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.