Form 1098, Mortgage Interest Statement

Quick Links

Background to Form 1098

Before we look at Form 1098, below is a little background.

What is the IRS Substitute 1098

Form 1098 is an Internal Revenue Service (IRS) form used to report the amount of interest and related expenses that are paid on a mortgage during a tax year, when the total is $600 or more.

Why are Mortgage Interest Deductions Important?

One of the most important tax deductions in the U.S. Tax Code , Mortgage Interest Tax Deduction allows homeowners to deduct the interest that they paid on their mortgage over the tax year. This means that the homeowner can reduce the amount of their income which is subject to taxation by the amount of interest that they have paid.

Restrictions

There are of course restrictions and it is important to understand these. For example, if you earn less than around $150,000 per year, you may be eligible for a deduction. If you earn more than this, you may not.

Claim Mortgage Interest Tax Deduction

Firstly, your borrower will need Form 1098 sent to their home address, usually within 6 weeks of the start of the year. The borrower will need to use this information to complete Schedule 1040 to file their taxes properly.

IRS links

Please make sure you review the links below to the IRS.gov website where you can find the latest information on Form 1098.

Why do we supply a Substitute form?

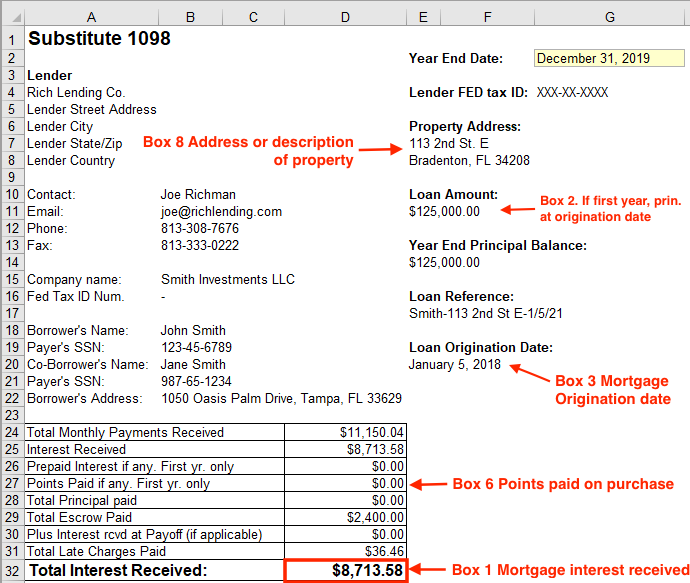

As noted above, we do not provide you with the actual up-to-date IRS Form 1098, but we do provide you with the information you need to complete it in an easy to read format.

We call our form a Substitute 1098 as it provides the information required, but it is NOT an IRS form. You must use their latest form which you can download from the IRS links above and NOT submit this form.

Create your Form to Print or Save

Click on the Sub 1098 worksheet.

All you need to do is enter a date in Cell G2, which should be the last day of the tax year. In our example, we want the form to report on all income for the 2020 year, so we entered 12/31/20.

Our form provides a lot of useful information about payments during the last tax year. The MOST IMPORTANT section is the Total Interest Received at the bottom of the form. This is the figure to enter in Box 1 on the IRS form.

You can either Print your letter to your printer or you can Save as a pdf. Learn more about printing and saving to pdf.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.