Annual Percentage Rate (APR)

Many borrowers do not understand about their mortgage interest rate or APR when they compare possible home loans. The mortgage interest rate is only part of the picture in comparing mortgage loans. Fees and charges on your mortgage loan can significantly increase the total cost of your mortgage.

What's the different between the Mortgage Interest Rate and APR?

The Annual Percentage Rate (APR) is designed to be a better indication of the true cost of a mortgage loan than the mortgage interest rate itself. That is because the APR takes into account other factors, for example:

- Interest Rate

- Points

- Fees

- Other Charges

The APR is different because it includes more than just the interest rate and is a broader measure of borrowing, as it takes into account the interest rate, points, fees and other charges, such as mortgage broker fees etc. For this reason, the APR is often higher than the interest rate.

What is Mortgage APR?

Mortgage APR is the annualised cost of credit on a mortgage loan. It is the interest rate that would produce the same monthly payment amount on your loan as if there were no fees or charges, if you rolled all of your fees and charges into the loan itself.

Example of Mortgage APR

The best way to start is to quickly compare two mortgage loans, with one having no fees and the other having points and finance charges. The APR figures shown are how we calculate it with Lender Spreadsheet Pro. Please note that other calculations can vary.

Loan 1 - NO additional charges

- Loan amount $125,000.00

- Term 30 years

- Interest Rate: 7.00%

- Fees and Charges: $0.00

Now compare this to a loan that has both points and additional charges.

Loan 2 - BOTH points and other charges

- Loan amount $125,000.00

- Term: 30 years

- Interest Rate: 7.00%

- Fees and Charges: 1 point and an admin charge of $1,000.00. 1 point is 1% of the loan value which means for a loan of $125,000.00 the charge for 1 point is $1,250.00. That means for this loan there are total charges of $2,250.00.

It is important to note that on Loan 2, the original loan principal amount of $125,000.00 is actually now $125,000.00 minus 1 point ($1,250.00) minus $1,000.00 admin charge, which means the APR is being calculated on a loan that is now $122,750.00.

What can be included in the APR?

The following fees are NORMALLY included in the APR:

- Points: Discount points and origination points.

- Pre-paid interest: The interest paid from the date the loan closes to the end of the month. If you close on January 5th, you will pay 27 days of pre-paid interest.

- Admin fee

- Loan Processing fee

- Underwriting fee

- Document Preparation fee

- Escrow Settlement fee

- Loan Application fee

- Credit Life Insurance (insurance to payoff the mortgage if the borrower dies)

- Attorney fee

- Title or abstract fee

- Notary fee

- Document Preparation by Closing Agent

- Home Inspection fees

- Transfer taxes

- Recording fees

- Credit reports

- Appraisal fee

How does Lender Spreadsheet Pro calculate APR?

Lender Spreadsheet Pro calculates APR using the Excel RATE function.

We take into account:

- The Amount Financed

- The Finance Charge

- The Number of Payments

How to Enter Points and other Finance Charges

Go to the Setup worksheet

There are 3 options for entering points and other charges:

1. Points Paid %

Total number of "points" purchased to reduce your mortgage's interest rate. Each 'point' costs 1% of your loan amount.

Enter a number that is a %, for example to add 1 point, enter '1'. You do not need to enter '%' after the number.

1 point on a $125,000.00 loan would cost $1,250.00.

As long as the points paid are not a broker's commission, they are considered tax deductible in the year that they were paid

2. Loan Origination Fee %

This is the percent of your loan charged as a loan origination fee.

For example, a 1% fee on a $125,000.00 loan would cost $1,250.00

Origination points are fees paid for the evaluation, processing, and approval of mortgage loans. The more discount points paid, the lower the interest rate on the mortgage.

1 point is typically equal to 1% of the mortgage amount. Unlike some other mortgage fees, origination points are not tax-deductible

3. Other Finance Charges

If you have any other finance charges, these can be entered here.

Example Points and Charges

Go to the Setup worksheet

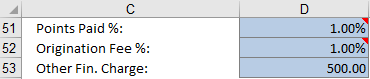

In our example below, we have enter 1 point for Points Paid and 1 point for the Origination Fee %. We have also entered 500.00 for other finance charges.

If the loan amount is $125,000.00, each 1 point is $1,250.00.

As there are 2 points entered, the total points is therefore $2,500.00.

If you include the $500.00 other finance charge, the total charges is therefore $3,000.00.

To enter Points Paid %, enter a number in Cell D51

To enter Origination Fee %, enter a number in Cell D52

To enter any other Finance Charges, enter a number in Cell D53

If you now look a the Loan Summary, you will see that the Amount Financed in Cell F55 is $122,000.00 and not the Principal Balance of $125,000.00, as the $3,000.00 in fees has been deduced.

As a further example, you can compare the Loan Summary above with the one below for a loan that has NO Points or other charges.

You will notice that the amount financed is the same as the principal balance and that the APR is less as there are NO fees.

Want to learn more about APR?

If you would like more information on APR check out the Consumer Finance Protect Bureau (cfpb)

Learn more about the difference between a mortgage interest rate and APR.

Calculate APR online NOW!

Visit our website Mortgage-Investments.com where you will find excellent FREE to use online financial calculators and spreadsheet downloads, including an APR Calculator.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.