SCENARIO 7: Last Two Payments NOT Paid, Mid Month Payoff and Daily Late Charge

In this seventh scenario, the borrower has made all their previous payments for January, February but not March and April 2021. They want a payoff commencing on May 15 2021. The difference for this scenario is that the Late Charge is a Daily Late Charge, NOT a Late Charge based on a % of the Monthly Payment. Learn more about the Daily Late Charge.

Quick Links

Record Payments

Click on the Record Payments worksheet.

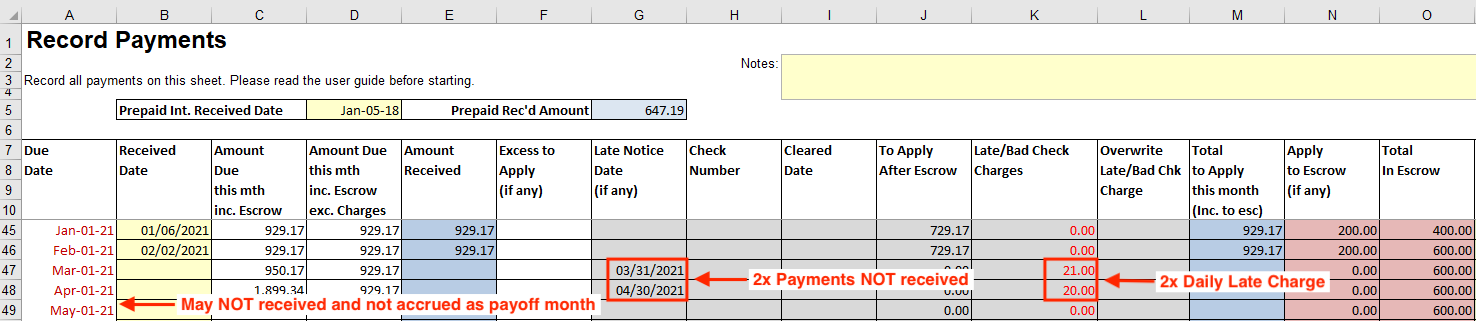

In our example image below, you will see that all the payments are up-to-date and entered. but the last two for March and April 2021 have been accrued as they were not received at all.

You do NOT need to accrue the payment for May 1 2021 as this is collected at Payoff. However, if you have received a payment for May 1 2021 then you would enter it.

Daily Late Charge

In our example, you'll see that the Late Charges are different for both March and April 2021.

Because NO payments were received at all, we have set the Daily Late Charge to be the end of the month that each payment is due (by entering these dates in Column G. You could set the date to be whatever you like depending on the terms of your loan by adjusting the date. Our example is just a guide for what you can do.

Our Daily Late Charge was set at $1 per day. For the March 1 2021 payment, the Days Before Late is 10 days, which means that if no payment was received, that would mean there are 21 days between the Late Charge triggering and the end of the month. That is why the Late Charge shown for the March 1 2021 payment is $21.

If the payment HAD been received but Late, the Daily Late Charge would be the difference between when the payment was officially Late and when it was actually received. You control this by entering a date in Column G.

Please see our section on Daily Late Charges and be cautious with using them and make sure it is legal to do so in your State.

To create your Payoff, click on the Payoff worksheet.

In our example, the date we want the Payoff to start is May 15 2021.

We entered 5/15/21 in Cell G2.

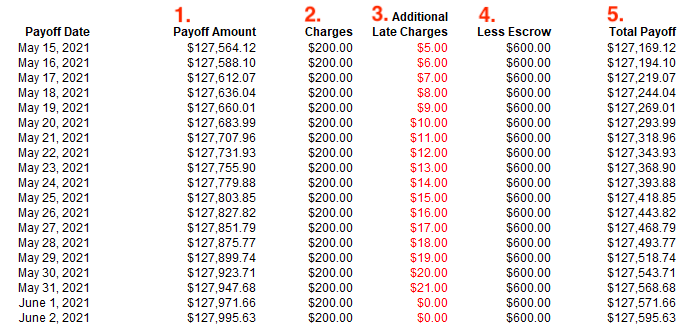

The lower section of your Payoff Statement will now look like the example below:

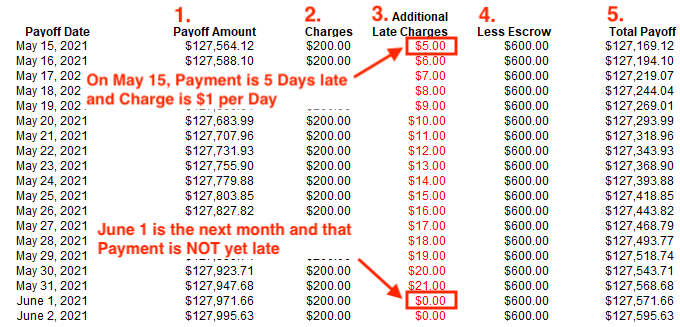

To explain further, for the Additional Late Charges column, you'll see that the Late Charge changes. This is because it is the Daily Late Charge.

On May 15 2021, your payment would be 5 days late as the Days Before Late was set to 10. That means that on the 15th, the Late Charge is $1 x 5 days = $5.

This increases each day by the Daily Late Charge of $1 up to a maximum of $21 which is the end of the month.

From June 1 2021, you'll see that the Late Charge is $0.00. This is because June is a new Month and the payment for June is not yet late until June 11 2021. The Daily Late Charge is ONLY for the month the payment is due and doesn't keep on increasing forever.

In our example loan, the loan is interest only and there is a balloon of $125,000.00.

No extra payments have been made to principal, so the outstanding balance is still $125,000.00.

- On May 15 2021, you will notice that the Payoff Amount is $127,564.12. This is because you are paying off in May and the March and April payments are due as they were not received. The May payment hasn't already been received and, because it's now the 15th of the month, a further 15 days of interest are due. The March and April payments include Daily Late Charges as these were accrued on the Record Payments worksheet.

- There is $200.00 shown as Charges, as this is what was entered in Cell G4.

- Additional Late Charges are different to the other examples as they are the Daily Late Charge. See above for a more detailed explanation. Any previously accrued Late Charges are included in the Payoff.

- The amount in escrow to be returned to the borrower. If for any reason there are amounts that are NOT to be returned to the borrower as they have been spent, then you need to close out the escrow in Record Payments. Learn more about Escrow.

- The Total Payoff is the Payoff Amount + Charges + Late Charge if applicable - Escrow.

REMEMBER: If you DO NOT want Late Charges showing in (3) above, then click on the Dropdown in Cell O25 and select 'No' and all further Late Charges for the Payoff month will be zero. For example, you agreed with your borrower the final payment would be paid at Payoff so you're not waiting for a check to clear before closing, so charging a Late Fee is not appropriate.

What do you do when you receive your Payoff?

Learn how to apply your Payoff and close off your loan.

Popular Links

How To

Let Us Help

Get in touch if you’re having problems, need something specific or have questions about our spreadsheet.

Claim FREE upgrade

Existing customers of Lender Software Pro v1.7.x claim a FREE upgrade to v2.0.x

Get started for FREE Today. Register and Download NOW!

Want to Upgrade from Lite to PRO?. Upgrade and Unlock for $79.99

Microsoft® Windows® and Microsoft® Excel® are registered trademarks of Microsoft Corporation in the United States and other countries. Mac® and macOS® are trademarks of Apple Inc., registered in the U.S. and other countries.